Invest in a Stunning Mattress: Best Use of Your Tax Refund

Your tax refund is more than just a momentary financial boost; it represents a unique opportunity to prioritize your well-being. Allocating these funds to invest in a high-quality mattress can vastly enhance your quality of life. Here’s why you should consider spending your tax refund on a mattress—not just as a purchase but as a transformative decision for your health and happiness.

The Importance of Quality Sleep

Sleep is the cornerstone of a healthy life. It influences our physical health, emotional stability, and daily productivity. By investing in a quality mattress, you’re making a commitment to significantly enhance your sleep quality, which directly contributes to your overall wellness.

We live in a demanding world, often filled with stress and fatigue. A quality mattress combats these challenges, helping alleviate tossing and turning while reducing discomfort from pressure points. This allows your body to enter deeper sleep cycles, which are essential for restorative rest. The transition to a better mattress means waking up rejuvenated and equipped to tackle the day ahead.

Long-Term Value of a Mattress Investment

When considering a mattress purchase, it’s crucial to view it as a long-term investment. While the initial expense may seem considerable, think of the enduring comfort it provides. On average, we spend about a third of our lives sleeping—transforming even a $1,000 mattress into merely 5 cents an hour over eight years.

This perspective can be quite revealing when compared to daily expenditures like that $3.50 latte you enjoy every morning. A quality mattress serves you far longer and plays a significant role in your health, making it an economically sound decision that benefits both your well-being and your finances.

Health Benefits of Upgrading Your Mattress

Investing your tax refund in a mattress opens the door to a multitude of health benefits. Here are a few key advantages:

1. Pain Relief: A high-quality, supportive mattress helps maintain proper spinal alignment, alleviating chronic pain and discomfort. For those suffering from back pain or joint issues, the right mattress can provide significant relief.

2. Allergy Reduction: Many modern mattresses are designed to be hypoallergenic, minimizing dust mites and allergens that disrupt sleep. This leads to a more comfortable and healthier sleeping environment.

3. Enhanced Mood: Quality sleep directly correlates with emotional well-being. Well-rested individuals usually experience reduced stress levels, fostering a more positive outlook on life.

By allocating your tax refund towards a mattress, you are ultimately investing in your health and mental well-being.

Customization: Tailored Comfort to Your Needs

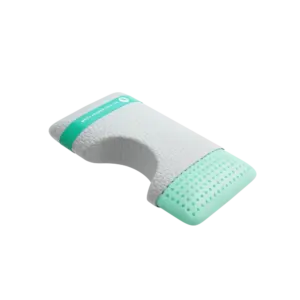

One of the most exciting aspects of today’s mattress market is the array of customization options available. A custom mattress, designed to meet your individual needs, can dramatically enhance your comfort and sleep quality.

– Tailored Support: Whether you prefer a firm or plush feel, custom mattresses allow for a selection of support levels that match your unique comfort preferences.

– Perfect Fit: Custom mattresses can accommodate unconventional bed sizes, ensuring that your investment seamlessly integrates into your sleeping space without sacrificing comfort.

The Economic Argument for Choosing Quality

Still on the fence about using your tax refund for a mattress? Consider the broader financial implications of a better night’s sleep. Research indicates that improved sleep correlates with enhanced workplace performance. When well-rested, you are more adept at tackling tasks, making sound decisions, and pursuing career advancements. Furthermore, investing in a quality mattress can lead to reduced healthcare costs associated with sleep deprivation and poor overall health.

Conclusion: A Mattress is an Investment in Your Future

Ultimately, spending your tax refund on a mattress transcends mere purchasing; it is a profound life-enhancing investment. It offers a chance to elevate your health, increase productivity, and enrich your overall well-being. A quality mattress serves as the bedrock of your physical and emotional health, allowing you to greet each day with renewed energy and optimism.

In conclusion, the advantages of investing in a quality mattress far outweigh the fleeting pleasures of other purchases. Embrace the opportunity for a restful night’s sleep. Use your tax refund wisely, investing in a mattress that satisfies your unique needs. Your path to a happier, healthier life begins with this critical choice. Explore the vast array of options available to find the perfect mattress that will support you for years to come.